Exhibit 99.2

Exhibit 99.2 BURGERFI ICR Conference January 2022

Exhibit 99.2

Exhibit 99.2 BURGERFI ICR Conference January 2022

Disclaimer BURGERFI FORWARD-LOOKING STATEMENTS This Presentation may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, including statements relating to BurgerFi International, Inc.’s (“BurgerFi” or the “Company”) estimates of its future business outlook, store opening plans, same store sales and restaurant operating margin growth plans, prospects or financial results. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our Annual Report on Form 10-K for the year ended December 31, 2020 and those discussed in other documents we file with the Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to BurgerFi or persons acting on BurgerFi’s behalf are expressly qualified in their entirety by the cautionary statements included in this presentation. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. NON-GAAP FINANCIAL MEASURES For discussion and reconciliation of non-GAAP financial measures, see slides 32-33 of this presentation. 2

BURGERFI Award-winning, fast casual “better burger” concept, delivering a delicious, all-natural burger experience ordered through our digital platforms or in our cool, modern, eco-friendly restaurants served by our passionate team members. 3

Anthony’s Coal Fired Pizza & Wings prides itself on serving fresh, never frozen, high-quality ingredients. Anthony’s menu offers “well-done” pizza, coal fired chicken wings, homemade meatballs, and a variety of handcrafted sandwiches and salads. 4

Synergies from Business Combination Strengthened Leadership: Newly appointed CEO, Ian Baines, has 40+ years experience with iconic companies such as Darden, Brinker, Uno’s, Cheddars, and Anthony’s. Baines’ solidified leadership team with new President of BurgerFi, Chief Development Officer and Chief Legal Officer and expanded roles for Chief Financial Officer, Chief Technology Officer, Chief People Officer and Senior Vice President of Marketing for synergy. Partnership with L Catterton: L Catterton is now one of the Company’s largest shareholders and Andrew Taub (Managing Partner at L Catterton) has joined BurgerFi’s board. L Catterton brings depth of expertise and strategic value. Digital Transformation: Technology platforms will serve to drive efficiencies, savings, improve labor management and data analytics to be leveraged by both brands. Incremental Franchising Opportunity at Anthony’s: Opportunity to cross-sell franchising opportunities across both brands given strong southeast footprint. Geographic Overlap Leverages Existing Infrastructure: Geographic expansion for both brands along the eastern seaboard will leverage existing infrastructure. 5

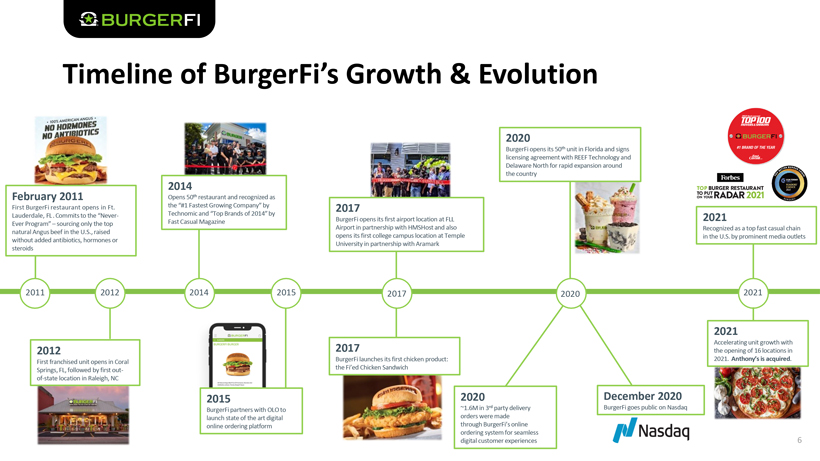

BURGERFI Timeline of BurgerFi’s Growth & Evolution February 2011 First BurgerFi restaurant opens in Ft. Lauderdale, FL. Commits to the “Never- Ever Program” – sourcing only the top natural Angus beef in the U.S., raised without added antibiotics, hormones or steroids 2014 Opens 50th restaurant and recognized as the “#1 Fastest Growing Company” by Technomic and “Top Brands of 2014” by Fast Casual Magazine 2017 BurgerFi opens its first airport location at FLL Airport in partnership with HMSHost and also opens its first college campus location at Temple University in partnership with Aramark 2020 BurgerFi opens its 50th unit in Florida and signs licensing agreement with REEF Technology and Delaware North for rapid expansion around the country 2021 Recognized as a top fast casual chain in the U.S. by prominent media outlets 2012 First franchised unit opens in Coral Springs, FL, followed by first out-of-state location in Raleigh, NC 2015 BurgerFi partners with OLO to launch state of the art digital online ordering platform 2017 BurgerFi launches its first chicken product: the Fi’ed Chicken Sandwich 2020 ~1.6M in 3rd party delivery orders were made through BurgerFi’s online ordering system for seamless digital customer experiences December 2020 BurgerFi goes public on Nasdaq 2021 Accelerating unit growth with the opening of 16 locations in 2021. Anthony’s is acquired. 2011 2012 2014 2015 2017 2020 2021 6

Experienced Executive Leadership Team Ian Baines Chief Executive Officer Over 40 years of experience in the casual dining and fast-casual industries with best-in-class companies such as Brinker, Darden, Uno’s, Cheddars and most recently Anthony’s Patrick Renna President BurgerFi Restaurant industry veteran with 25 years of experience at Anthony’s, Chili’s, Bertucci’s, Wahlburger’s and Boloco Karl Goodhew Chief Technology Officer Over 15 years of software development experience with Fortune 500 companies Michelle Zavolta Chief People Officer More than 20 years experience with companies such as Anthony’s, Rare Hospitality, Logan’s Roadhouse and Ted’s Montana Grill Michael Rabinovitch Chief Financial Officer Ron Biskin Chief Development Officer Stefan Schnopp Chief Legal Officer & Secretary Nadia Cronk Senior Vice President, Marketing Over 25 years of extensive financial experience with best-in-class public companies such as Tech Data, Office Depot, Mayors Jewelers and Claire’s Over 25 years of restaurant company leadership with national and international brands such as TGI Friday’s, Chili’s, Baja Fresh, Burger King, Wolfgang Puck and Native Foods Extensive experience advising public company leadership on complex legal matters, and a key leader in effecting the T-Mobile-Sprint merger Over 15 years of marketing national restaurant brands such as Anthony’s, Bloomin’ Brands, and Fortune 500 companies 7

Board of Directors • Over 25 years of real estate industry experience Ophir Sternberg • Founder of Lionheart Capital LLC Executive Chairman • Founder and Managing Partner of Oz Holdings LLC Gregory Mann • Almost a decade of advising, consulting, leadership and managerial roles Independent Director • Experienced board member and Vivian Lopez-Blanco seasoned finance executive dependent Director • Expertise in organizational transformation air of the Audit • Previously CFO at both Mednax, Inc. and mmittee the Hispanic restaurant division of Carrols Corp. • Founder of Martha Stewart Living Martha Stewart Omnimedia • Emmy and James Beard award-winning Independent Director television show host Chair of Product & • Named to “50 Most Powerful Women” Innovation Committee and “100 Greatest Living Business Minds” Allison Greenfield Over 20 years of real estate development • Independent Director experience Chair of Compensation • Partner at Lionheart Capital LLC with over & Nominating 25 years of experience in entitlement, Committee design, construction and management • More than 25 years experience managing Andrew Taub and investing in restaurant/retail portfolios Independent Director • Managing Partner at L Catterton since 1996 8

BurgerFi

Business Snapshot – BurgerFi Brand Founded in 2011 25 Corporate Owned Locations (1) 93 Franchisee Owned Locations (1) $166M System-wide Sales (2) (3) $46M Total Revenue (2) 1) As of December 31, 2021. 2) Preliminary—for the twelve months ended December 31, 2021. 3) See slide 33 for key metrics definitions. 10

BURGERFI Environmental, Social, Governance (ESG) ENVIRONMENTAL SOCIAL GOVERNANCE Responsible Sourcing • BurgerFi is built Environmental on a foundation of transparency & quality – e.g., No Antibiotics Ever (N.A.E.) and locally sourced produce whenever possible Earth-friendly restaurant designs • All-natural southern pine lumber for our wood walls • Energy efficient appliances COPY COPY –COPY e.g., LED lights, energy efficient fans • Upcycled furnishings such as chairs made from recycled Coca-Coca bottles • Recycle our cooking oil to be made into biofuel • Switch from plastic to paper products • Automatic water valves, reducing annual water consumption Training & education • Fi-Way to upward mobility • Developing Impactful Leaders course • Certified Restaurant Trainer Program Inclusive & supportive environment • Competitive benefits (PTO & health) • Code of Conduct includes commitments to non-discrimination, anti-harassment, & safety Deep Community Involvement • Marcum Foundation Partnership • Palm Beach Atlantic Univ. Titus Center for Franchising Food safety • Quarterly independent Steritech audits for all restaurants COVID-19 response • Enhanced team member & guest safety measures 80% Independent Board of Directors 80% Diversity on Board of Directors Franchise Advisory Council Robust Compliance Policies • Brand shield to uphold integrity & ethical standards • Confidential, independent 24/7 hotline for team members • External Communications Policy • Social Media Policy • Non-Fraternization Policy • Conflicts of interest, anti-kickback policy • Insider trading policy • No lobbying activities or political contributions 11

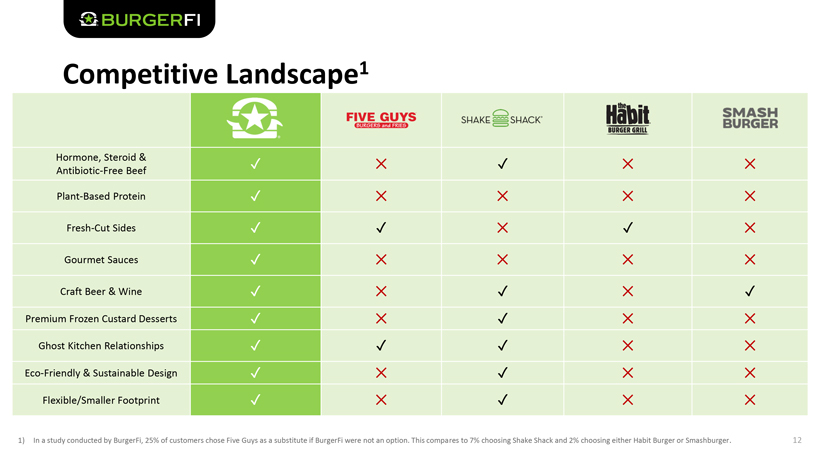

BURGERFI Competitive Landscape1 Hormone, Steroid & Antibiotic-Free Beef Plant-Based Protein Fresh-Cut Sides Gourmet Sauces Craft Beer & Wine Premium Frozen Custard Desserts Ghost Kitchen Relationships Eco-Friendly & Sustainable Design Flexible/Smaller Footprint 1) In a study conducted by BurgerFi, 25% of customers chose Five Guys as a substitute if BurgerFi were not an option. This compares to 7% choosing Shake Shack and 2% choosing either Habit Burger or Smashburger. 12

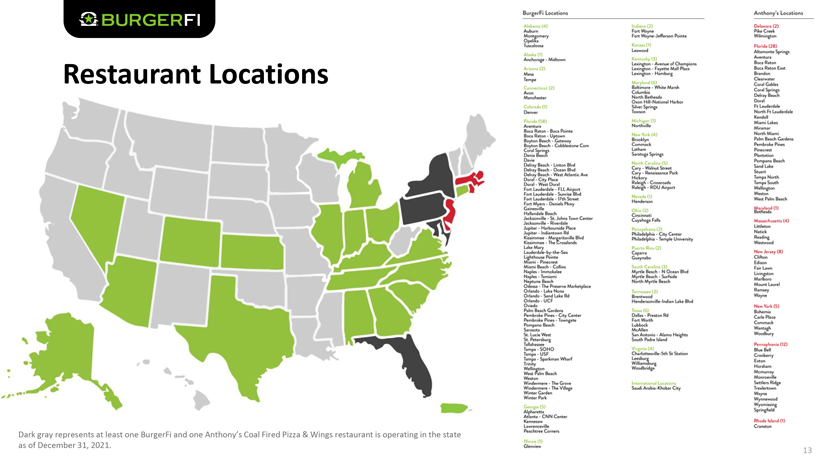

BURGERFI Restaurant Locations Alabama (4) Auburn Montgomery Opeliks Tuscaloosa Alaska (1) Anchorage - Midtown Arizona (2) Mesa Tempe Connecticut (2) Avon Manchester Colorado (1) Denver Florida (58) Aventura Boca Raton - Boca Pointe Boca Raton - Uptown Boyton Beach - Gateway Boyton Beach - Cobblestone Com Coral Springs Dania Beach Davie Delray Beach - Linton Blvd Delray Beach - Ocean Blvd Delray Beach - West Atlantic Ave Doral - City Place Doral - West Doral Fort Lauderdale - FLL Airport Fort Lauderdale - Sunrise Blvd Fort Lauderdale - 17th Street Fort Myers - Daniels Pkwy Gainesville Hallandale Beach Jacksonville - St. Johns Town Center Jacksonville - Riverdale Jupiter - Harbourside Place Jupiter - Indiantown Rd Kissimmee - Margaritaville Blvd Kissimmee - The Crosslands Lake Mary Lauderdale-by-the-Sea Lighthouse Pointe Miami - Pinecrest Miami Beach - Collins Naples - Immokalee Naples - Tamiami Neptune Beach Odessa - The Preserve Marketplace Orlando - Lake Nona Orlando - Sand Lake Rd Orlando - UCF Oviedo Palm Beach Gardens Pembroke Pines - City Center Pembroke Pines - Towingate Pompano Beach Sarasota St. Lucie West St. Petersburg Tallahas Tampa - SOHO Tampa - USF Tampo-Sparkman Wharf Trinity Wellington West Palm Beach Weston Windermere - The Grove Windermere - The Village Winter Garden Winter Park Georgia (5) Alpharetta Atlanta - CNN Center Kennesaw Lawrenceville Peachtree Corners Illinois (1) Glenview Indiana (2) Fort Wayne Fort Wayne-Jefferson Pointe Kansas (1) Leawood Kentucky (3) Lexington - Avenue of Champions Lexington - Fayette Mall Plaza Lexington - Hamburg Maryland (6) Baltimore - White Marsh Columbia North Bathesda Oxon Hill-National Harbor Silver Springs Towson Michigan (1) Northville New York (4) Brooklyn Commack Latham Saratoga Springs North Carolina (5) Cary - Walnut Street Cary - Renaissance Park Hickory Raleigh - Crossroads Raleh - RDU Airport Nevada (1) Henderson Ohio (2) Cincinnati Cuyahoga Falls Perrysly aria (2) Philadelphia - City Center Philadelphia - Temple University Puerto Rico (2) Caparra Guaynabo South Carolina (3) Myrtle Beach - N Ocean Blvd Myrtle Beach - Surfside North Myrtle Beach Tennessee (2) Brentwood Hendersonville-Indian Lake Blvd Texas (6) Dallas - Preston Rd Fort Worth Lubbock McAllen San Antonio - Alamo Heights South Padre Island Virginia (4) Charlottesville-5th St Station Leesburg Williamsburg Woodbridge International Locations Saudi Arabia-Khobar City Anthony’s Locations Delaware (2) Pike Creek Wilmington Florida (28) Altamonte Springs Aventura Boca Raton Boca Raton East Brandon Clearwater Coral Gables Coral Springs Delray Beach Doral Ft Lauderdale North Ft Lauderdale Kendall Miami Lakes Miramar North Miami Palm Beach Gardens Pembroke Pines Pinecrest Plantation Pompano Beach Sand Lake Stuart Tampa North Tampa South Wellington Weston West Palm Beach Maryland (1) Bethesda Massachusetts (4) Littleton Natick Reading Westwood New Jersey (8) Clifton Edison Fair Lawn Livingston Marlboro Mount Laurel Ramsey Wayne New York (5) Bohemia Carle Place Commack Wantagh Woodbury Pennsylvania (12) Blue Bell Cranberry Exton Horsham Mcmurray Monroeville Settlers Ridge Trexlertown Wayne Wynnewood Wyomissing Springfield Rhode Island (1) Cranston Dark gray represents at least one BurgerFi and one Anthony’s Coal Fired Pizza & Wings restaurant is operating in the state as of December 31, 2021.

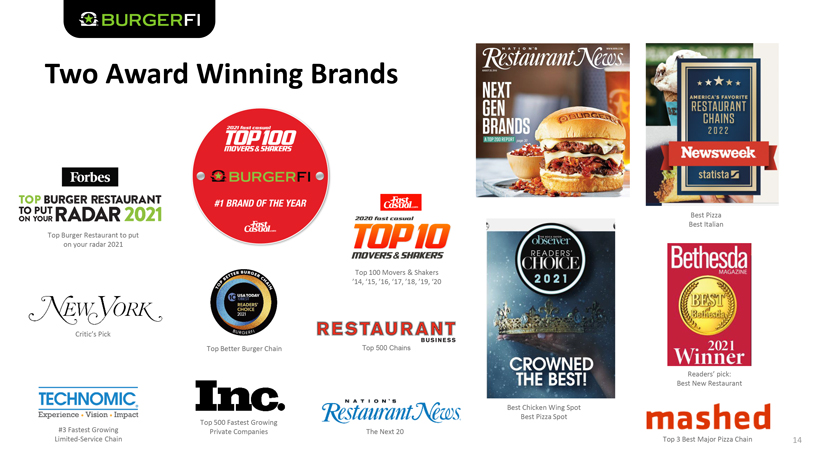

Two Award Winning Brands 2021 fast casual TOP100 MOVERS & SHAKERS BURGERFIO #1 BRAND OF THE YEAR Forbes TOP BURGER RESTAURANT ON UN POUR RADAR 2021 Top Burger Restaurant to put on your radar 2021 Casual 2020 Fast CON Fast Casuo. TOP 10 GURGER MOVERS & SHAKERS Top 100 Movers & Shakers ‘14, ‘15, ‘16, ‘17, ‘18, ‘19, 20 LA CHAIN 1C NEW YORK USA TODAY READERS CHOICE 2021 Critic’s Pick BURGERFI RESTAURANT BUSINESS Top Better Burger Chain Top 500 Chains Inc. TECHNOMIC Experience Vision Impact #3 Fastest growing Limited-Service Chain Restaurant News Top 500 Fastest growing Private Companies The Next 20 Restaurant News NEXT GEN BURGEL BRANDS AMERICA’S FAVORITE e A TOP 200 REPORT RESTAURANT CHAINS 2022 Newsweek statista Best Pizza Best Italian observer READERS (CHOICE 2021 Bethesda MAGAZINE DEPO BEST Bethesda KELEE 2021 Winner CROWNED THE BEST! Readers’ pick: Best New Restaurant Best Chicken Wing Spot Best Pizza Spot mashed Top 3 Best Major Pizza Chain Top Burger Restaurant to put on your radar 2021

Anthony’s Coal Fired Pizza & Wings

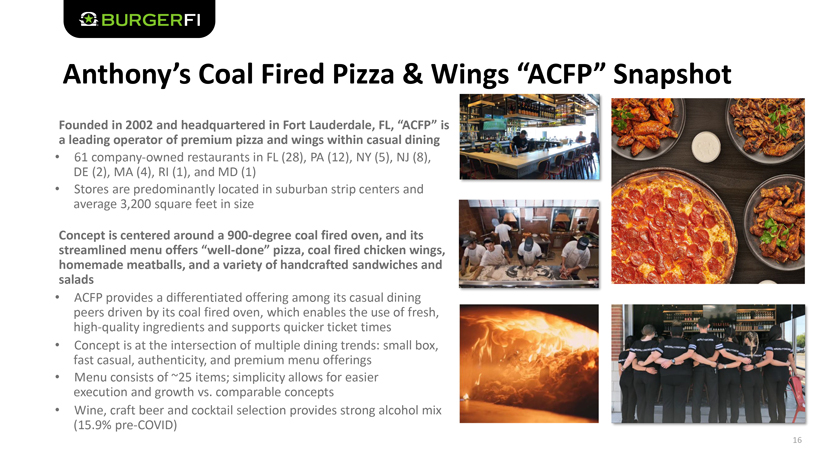

Anthony’s Coal Fired Pizza & Wings “ACFP” Snapshot Founded in 2002 and headquartered in Fort Lauderdale, FL, “ACFP” is a leading operator of premium pizza and wings within casual dining • 61 company-owned restaurants in FL (28), PA (12), NY (5), NJ (8), DE (2), MA (4), RI (1), and MD (1) • Stores are predominantly located in suburban strip centers and average 3,200 square feet in size Concept is centered around a 900-degree coal fired oven, and its streamlined menu offers “well-done” pizza, coal fired chicken wings, homemade meatballs, and a variety of handcrafted sandwiches and salads • ACFP provides a differentiated offering among its casual dining peers driven by its coal fired oven, which enables the use of fresh, high-quality ingredients and supports quicker ticket times • Concept is at the intersection of multiple dining trends: small box, fast casual, authenticity, and premium menu offerings • Menu consists of ~25 items; simplicity allows for easier execution and growth vs. comparable concepts • Wine, craft beer and cocktail selection provides strong alcohol mix (15.9% pre-COVID) 16

BURGERFI ACFP’s Normalized Unit Metrics ($ in millions) Total Store Count1 61 Average Unit Volume (AUV)2 $2.3 Unit-Level Operating Margin3 19% 1) # of Restaurants as of December 31, 2021. 2) AUV’s are representative of pre-COVID-19 levels. 3) Unit-Level Operating Margin is based on ACFP’s sales and unit-level operating margin performance metrics pre-COVID-19. No predictions or assurances are being made as to when or if the metrics experienced before COVID-19 will be realized as it relates to Average Unit Volumes and unit-level operating margin. 17

BURGERFI New ACFP Prototype Under Development New smaller prototype increases long-term growth opportunity • Developing new prototype with a 2,200 square foot model vs. the traditional 3,200 square foot version • Increases optionality on sites • Improves unit economics • Expands total addressable market 18

BURGERFI Technology & Innovation 19

BURGERFI Improved Oven Performance Quick and consistent coal-fired oven with gas assist • The oven is the heart of Anthony’s Coal Fired Pizza & Wings: everything but our salad and cheesecake is cooked in our ovens • New oven maintains signature coal fired char, while gas assist function allows for easier execution • Double the capacity, up to 15 16’’ pizzas • Uses far less coal (40lbs vs. 320-400lbs) • ~5 minutes to cook First of its kind coal fired rotating-deck oven testing for Ghost Kitchens • Still imparts the unique char flavor to pizza and wings 20

Digital Innovation Data-Driven Loyalty + Mobile App • Single platform for vendor integrations • Easily scalable to multiple concepts • Integrated loyalty with automated, smart promotions and marketing • Enhanced Customer Data Platform to analyze guest data and market with personalized incentives State-of-the-Art Self-Ordering Kiosks • ~50% of in-restaurant orders flow through kiosk • + 16% higher check average • Dynamic upsell • Automated POS integration • Cloud-Based Content Management System • Marketing video content for screensaver D i g i t a l I n n o v a t i o n + K i o s k P i l o t L i v e i n 4 R e s t a u r a n t s w i t h R a p i d E x p a n s i o n P l a n n e d 21

Patty-the-Robot and Curbside Smartwatch Notifications Contactless Curbside Pick-Up • Informing servers via Smartwatch when customer arrives • Streamlining customer experience and in-house efficiencies Leading-Edge Robotic Food Server • Help combat labor shortages • Restaurant-mapping programmed to deliver food to specific tables • Uses LiDAR and optical sensors for real-time navigation and obstacle avoidance • Novelty aspect elevates experience P r o d u c t i o n & P i l o t P r o g r a m 22

Digital Ordering AI-Powered Voice • Phone orders via voice user interface integrated direct to POS • Verbal AI guided ordering process • 700k phone orders per year • 90% expected to be handled by AI QR Code Technology • Touchless embedded NFC • Direct to POS • Increases throughput as staff focused on hospitality and food preparation • Upsell and additional add-ons during or after the meal In-Car Voice Activated • Order with voice or via interactive dash • Curbside pickup with notification to the restaurant upon arrival • Smart order time placement based on drive time and order-make time • Coming summer 2022 in 5G enabled cars P i l o t P r o g r a m 23

Investment in Customer Experience Through Technology Omnichannel customer experience provides the BurgerFi experience at home, in the restaurant and on the roa Renewed focus on the user experience at all touch points, including mobile app, website, kiosk, drive thru and front of house systems Using cloud technology, such as artificial intelligence and machine learning, to make data-based decisions Innovating with experienced partners to deliver food autonomously and explore the boundaries of food delivery 24

Growth Strategy 25

DEVELOPMENT STRATEGY: Company-Owned & Franchised Leveraging dominant position as premier “better burger” and “premium pizza and wings” in Florida Grow presence on Eastern seaboard and other important markets in Southeast, Mid-Atlantic and Northeast for BurgerFi & Anthony’s Coal Fired Pizza & Wings Start with 2-3 company-owned restaurants in key “cluster cities” such as Tampa, Jacksonville, Atlanta & Nashville, add current and future franchisee growth, to: Drive brand awareness through ad fund growth and impact Provide operational training support Seeking multi-unit franchise deals in adjacent Southeast markets and opportunistic deals in other U.S. regions Pursuing additional international franchises as countries open borders, including Saudi Arabia this year 26

BURGERFI Ghost Kitchens: Additional Revenue Driver • Anthony’s virtual wing concept, The Roasted Wing, is available through 3rd party delivery for all 61 locations • BurgerFi accelerated growth of delivery-only ghost kitchens: 22 open as of 12/31/2021 27

BURGERFI 2021 Growth Metrics BurgerFi remains optimistic about its short-term and long-term prospects Opened 16 new BurgerFi restaurants in 2021 Systemwide sales growth over 30% including same-store sales over 13% 28

Latest Financial Results 29

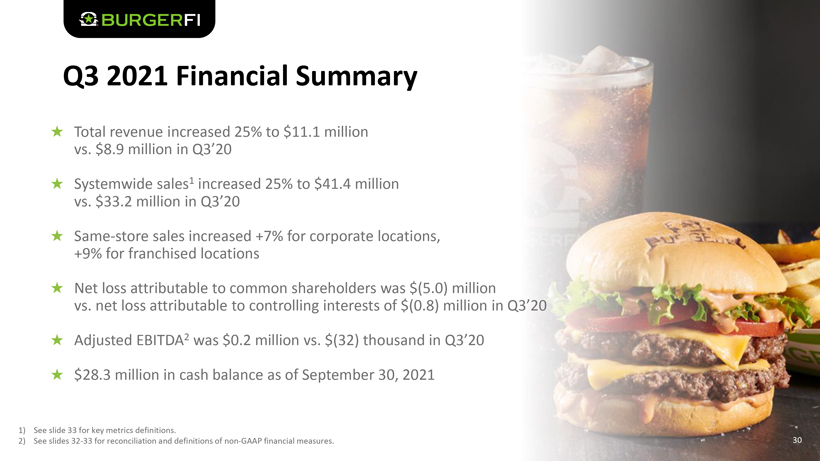

BURGERFI Q3 2021 Financial Summary Total revenue increased 25% to $11.1 million vs. $8.9 million in Q3’20 Systemwide sales1 increased 25% to $41.4 million vs. $33.2 million in Q3’20 Same-store sales increased +7% for corporate locations, +9% for franchised locations Net loss attributable to common shareholders was $(5.0) million vs. net loss attributable to controlling interests of $(0.8) million in Q3’20 Adjusted EBITDA2 was $0.2 million vs. $(32) thousand in Q3’20 $28.3 million in cash balance as of September 30, 2021 1) See slide 33 for key metrics definitions. 2) See slides 32-33 for reconciliation and definitions of non-GAAP financial measures. 30

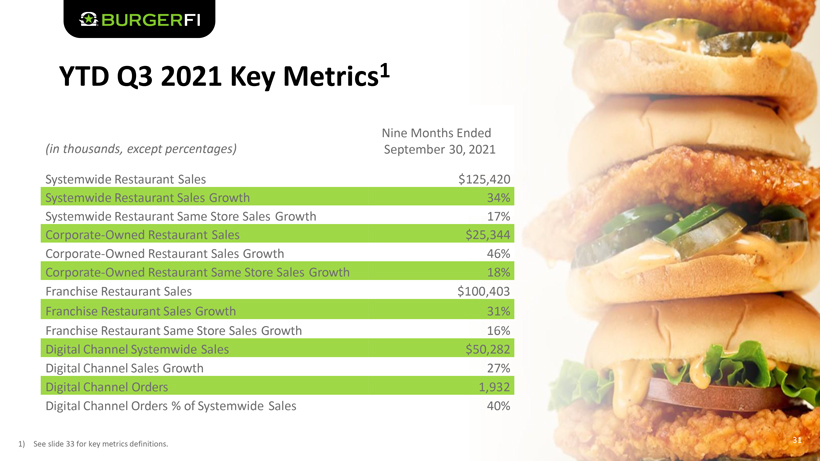

YTD Q3 2021 Key Metrics1 Nine Months Ended (in thousands, except percentages) September 30, 2021 Systemwide Restaurant Sales $125,420 Systemwide Restaurant Sales Growth 34% Systemwide Restaurant Same Store Sales Growth 17% Corporate-Owned Restaurant Sales $25,344 Corporate-Owned Restaurant Sales Growth 46% Corporate-Owned Restaurant Same Store Sales Growth 18% Franchise Restaurant Sales $100,403 Franchise Restaurant Sales Growth 31% Franchise Restaurant Same Store Sales Growth 16% Digital Channel Systemwide Sales $50,282 Digital Channel Sales Growth 27% Digital Channel Orders 1,932 Digital Channel Orders % of Systemwide Sales 40% 1) See slide 33 for key metrics definitions. 31

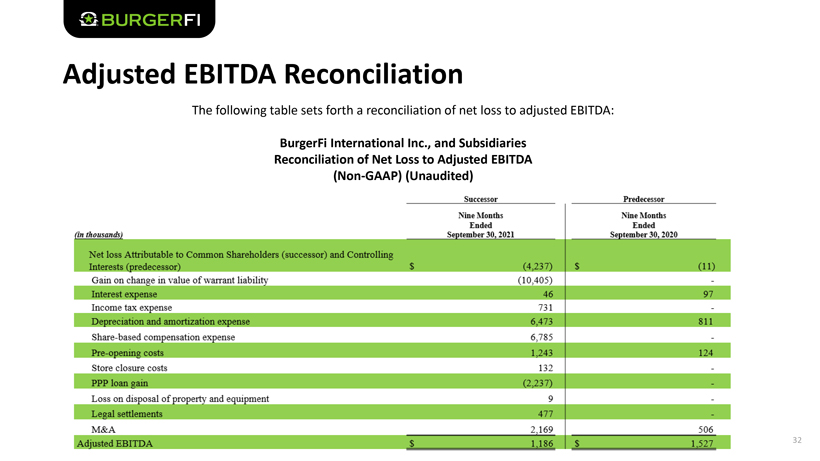

Adjusted EBITDA Reconciliation The following table sets forth a reconciliation of net loss to adjusted EBITDA: BurgerFi International Inc., and Subsidiaries Reconciliation of Net Loss to Adjusted EBITDA (Non-GAAP) (Unaudited) Successor Predecessor Nine Months Ended September 30, 2021 Nine Months Ended September 30, 2020 in thousands) (11) 97 811 Net loss Attributable to Common Shareholders (successor) and Controlling Interests (predecessor) Gain on change in value of warrant liability Interest expense Income tax expense Depreciation and amortization expense Share-based compensation expense Pre-opening costs Store closure costs PPP loan gain Loss on disposal of property and equipment Legal settlements 252931-001 10Jan2022 02:01 QTA Page 38 M&A Adjusted EBITDA (4,237) (10,405) 46 731 6,473 6,785 1,243 132 (2,237) 9 477 2,169 1.186 124 506 1,527 32

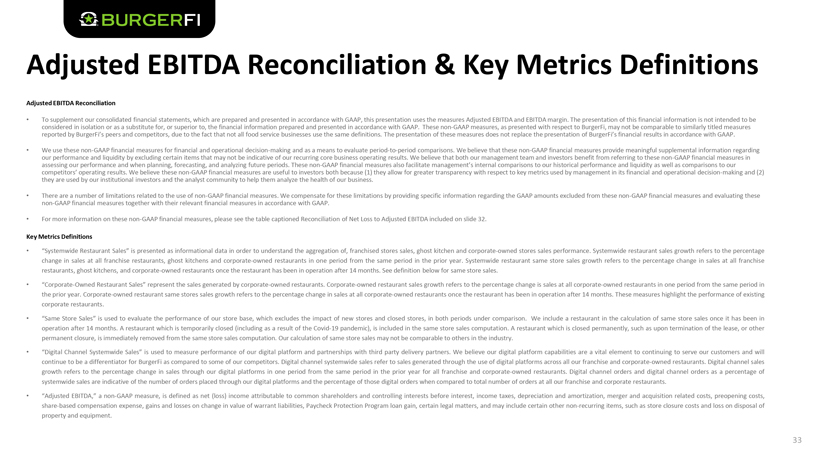

Adjusted EBITDA Reconciliation & Key Metrics Definitions Adjusted EBITDA Reconciliation • To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, this presentation uses the measures Adjusted EBITDA and EBITDA margin. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. These non-GAAP measures, as presented with respect to BurgerFi, may not be comparable to similarly titled measures reported by BurgerFi’s peers and competitors, due to the fact that not all food service businesses use the same definitions. The presentation of these measures does not replace the presentation of BurgerFi’s financial results in accordance with GAAP. • We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results. We believe that both our management team and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business. • There are a number of limitations related to the use of non-GAAP financial measures. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP financial measures and evaluating these non-GAAP financial measures together with their relevant financial measures in accordance with GAAP. • For more information on these non-GAAP financial measures, please see the table captioned Reconciliation of Net Loss to Adjusted EBITDA included on slide 32. Key Metrics Definitions • “Systemwide Restaurant Sales” is presented as informational data in order to understand the aggregation of, franchised stores sales, ghost kitchen and corporate-owned stores sales performance. Systemwide restaurant sales growth refers to the percentage change in sales at all franchise restaurants, ghost kitchens and corporate-owned restaurants in one period from the same period in the prior year. Systemwide restaurant same store sales growth refers to the percentage change in sales at all franchise restaurants, ghost kitchens, and corporate-owned restaurants once the restaurant has been in operation after 14 months. See definition below for same store sales. • “Corporate-Owned Restaurant Sales” represent the sales generated by corporate-owned restaurants. Corporate-owned restaurant sales growth refers to the percentage change is sales at all corporate-owned restaurants in one period from the same period in the prior year. Corporate-owned restaurant same stores sales growth refers to the percentage change in sales at all corporate-owned restaurants once the restaurant has been in operation after 14 months. These measures highlight the performance of existing corporate restaurants. • “Same Store Sales” is used to evaluate the performance of our store base, which excludes the impact of new stores and closed stores, in both periods under comparison. We include a restaurant in the calculation of same store sales once it has been in operation after 14 months. A restaurant which is temporarily closed (including as a result of the Covid-19 pandemic), is included in the same store sales computation. A restaurant which is closed permanently, such as upon termination of the lease, or other permanent closure, is immediately removed from the same store sales computation. Our calculation of same store sales may not be comparable to others in the industry. • “Digital Channel Systemwide Sales” is used to measure performance of our digital platform and partnerships with third party delivery partners. We believe our digital platform capabilities are a vital element to continuing to serve our customers and will continue to be a differentiator for BurgerFi as compared to some of our competitors. Digital channel systemwide sales refer to sales generated through the use of digital platforms across all our franchise and corporate-owned restaurants. Digital channel sales growth refers to the percentage change in sales through our digital platforms in one period from the same period in the prior year for all franchise and corporate-owned restaurants. Digital channel orders and digital channel orders as a percentage of systemwide sales are indicative of the number of orders placed through our digital platforms and the percentage of those digital orders when compared to total number of orders at all our franchise and corporate restaurants. • “Adjusted EBITDA,” a non-GAAP measure, is defined as net (loss) income attributable to common shareholders and controlling interests before interest, income taxes, depreciation and amortization, merger and acquisition related costs, preopening costs, share-based compensation expense, gains and losses on change in value of warrant liabilities, Paycheck Protection Program loan gain, certain legal matters, and may include certain other non-recurring items, such as store closure costs and loss on disposal of property and equipment. 33

Key Takeaways 34

Investment Highlights Award-winning, “better burger” concept that is well-positioned for expansion with a strong balance sheet plus an experienced and motivated senior management team. Significant runway for growth coming out of the pandemic. Opened 16 BurgerFi locations in 2021. In addition, grew Ghost Kitchens to 22 locations at 12/31/2021. Unique expansion opportunities to grow the BurgerFi & Anthony’s brands outside of restaurants, including ghost kitchens and non-traditional venues. Tech-enabled ordering system and loyalty platform to meet the evolving preferences of today’s consumer, ultimately driving revenue growth. BurgerFi was named a top fast casual chain in the U.S. by three prominent media outlets in 2021 and recognized by multiple food and consumer institutions for best-in-class quality of ingredients. Strong profitability from Anthony’s and opportunities for growth along the Eastern Seaboard. A new, smaller footprint Anthony’s provides enhanced returns and increases the addressable market. Significant cross selling opportunities and ability to franchise Anthony’s. 35

Investor Relations Contact Contact Us Lynne Collier (646) 430-2216 IR-BFI@icrinc.com