Q2’21 Earnings Presentation AUGUST 12, 2021 Exhibit 99.2

Disclaimer FORWARD-LOOKING STATEMENTS This Presentation may contain "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995, including statements relating to BurgerFi International, Inc.’s (“BurgerFi or the “Company”) estimates of its future business outlook, prospects or financial results. Forward-looking statements generally can be identified by words such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "predicts," "projects," "will be," "will continue," "will likely result," and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our Annual Report on Form 10-K for the year ended December 31, 2020 and those discussed in other documents we file with the Securities and Exchange Commission. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. NON-GAAP FINANCIAL MEASURES For discussion and reconciliation of non-GAAP financial measures, see appendix of this presentation. 2 2

3 Award-winning, fast casual “better burger” concept, delivering a delicious, all-natural burger experience conveniently available through our digital platforms or in our cool, modern, eco-friendly restaurants served by our passionate team members. 3 3

Second Quarter 2021 Financial Results & Recent Highlights 4

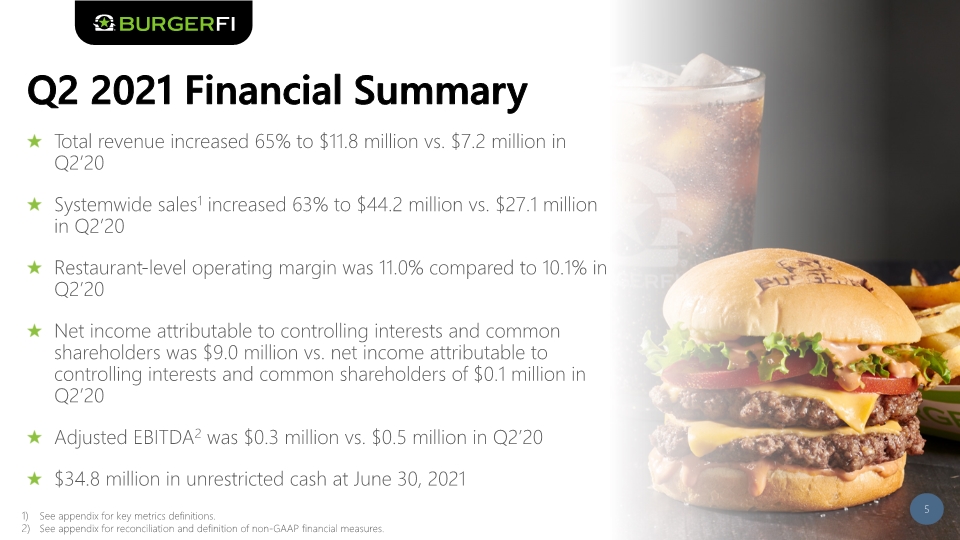

Q2 2021 Financial Summary Total revenue increased 65% to $11.8 million vs. $7.2 million in Q2’20 Systemwide sales1 increased 63% to $44.2 million vs. $27.1 million in Q2’20 Restaurant-level operating margin was 11.0% compared to 10.1% in Q2’20 Net income attributable to controlling interests and common shareholders was $9.0 million vs. net income attributable to controlling interests and common shareholders of $0.1 million in Q2’20 Adjusted EBITDA2 was $0.3 million vs. $0.5 million in Q2’20 $34.8 million in unrestricted cash at June 30, 2021 5 See appendix for key metrics definitions. See appendix for reconciliation and definition of non-GAAP financial measures. 5

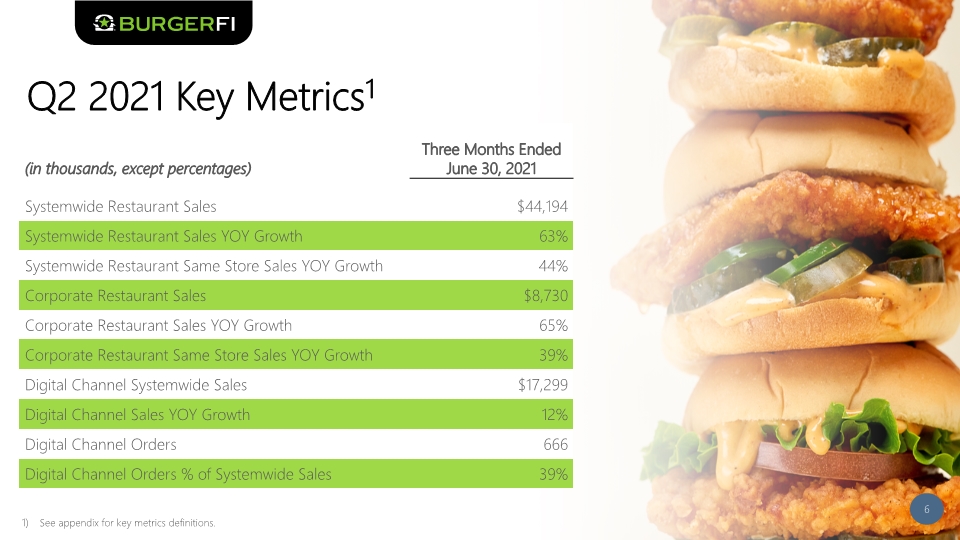

Q2 2021 Key Metrics1 6 Please make a similar fade away image like this, but I don’t want it to have an identical image to slide 5 See appendix for key metrics definitions. 6

Recent Operational Highlights Bolstered senior management team since start of 2021: CFO – Michael Rabinovitch, over 25 years of extensive financial leadership experience with best-in-class public companies COO – Jim Esposito, QSR-industry veteran with over 20 years of experience at Burger King, Panera Bread and Papa Gino’s CMO – Henry Gonzalez, over 25 years of food and retail experience working with leading national and global brands like Burger King, McDonald’s, Walmart, Home Depot and Infiniti CTO – Karl Goodhew, over 15 years of software development experience with Fortune 500 companies 7

Recent Brand Highlights The SWAG burger LTO introduced in March doubled premium wagyu burger sales and became a permanent menu item in July Enhanced mobile app order customization capabilities improving customer experience Continually recognized as a top fast casual chain in the U.S.: Named “#1 Brand of the Year” in Fast Casual’s Top 100 Movers & Shakers list for 2021 Secured top ranking as 2021 Best Better Burger Fast Casual Restaurant in USA Today Recognized by Forbes as a “Fast Casual Chain That Should Be On Your Radar in 2021” 8 8

Growth Strategy 9 9

Strategically Positioned “Better Burger” Concept 10 ALL NATURAL, CHEF-CREATED BEEF & PLANT-BASED ITEMS COMMITMENT TO SUSTAINABILITY EXPANDING REACH THROUGH GHOST KITCHENS & DRIVE THRU DIGITAL ORDERING AND LOYALTY PLATFORMS 10

DEVELOPMENT STRATEGY: Company-Owned & Franchise Restaurants Leveraging dominant position as the premier “better burger” chain in Florida Focusing growth up Eastern seaboard to other important markets in Southeast, Mid-Atlantic and Northeast Expanding with 2-3 company-owned restaurants in key “cluster cities” like Tampa, Jacksonville, Atlanta & Nashville, along with current and future franchisee growth, to: Pool marketing and ad spend for maximum impact Provide operational training support Seeking franchise multi-unit deals in adjacent Southeast markets and opportunistic deals in other U.S. regions Pursuing additional international franchises as countries open borders, including Saudi Arabia later this year 11

DEVELOPMENT STRATEGY: Ghost Kitchens/Institutional Opportunities Accelerate growth of ghost kitchens with multiple partners Add 15-20 new Ghost Kitchens in 2021 to existing footprint in key growth markets with Reef Kitchens and Epic Kitchens in Chicago Continue to grow in airports with multiple institutional players like Aramark, HMS Host, SSP, Delaware North, Master ConcessionAir, etc. Explore other non-traditional options like: College campuses Train stations Motorways Sports venues 12 12

2021 Outlook 13 Please make a similar fade away image like this, but I don’t want it to have an identical image to slide 5 BurgerFi remains optimistic about its short-term and long-term prospects and is providing the following limited modeling assumptions for 20211: Plan to open between 25-30 new restaurants in 2021 as well as 15-20 ghost kitchens Restaurant operating margins to improve to between 14% and 16% of restaurant sales as a result of price increases and operating efficiencies Capital expenditures are planned to be approximately $15 million for 2021 primarily to support company store development These projections do not consider the potential impact from a Covid resurgence 13

Appendix 14 14

Adjusted EBITDA Reconciliation & Key Metrics Definitions Adjusted EBITDA Reconciliation To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the measure Adjusted EBITDA. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use this non-GAAP financial measure for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that this non-GAAP financial measure provides meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results. We believe that both management and investors benefit from referring to this non-GAAP financial measure in assessing our performance and when planning, forecasting, and analyzing future periods. This non-GAAP financial measure also facilitates management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe this non-GAAP financial measure is useful to investors both because (1) it allows for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) it is used by our institutional investors and the analyst community to help them analyze the health of our business. There are a number of limitations related to the use of non-GAAP financial measures. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from this non-GAAP financial measure and evaluating this non-GAAP financial measure together with its relevant financial measures in accordance with GAAP. For more information on this non-GAAP financial measures, please see the tables captioned Reconciliation of Net Income (Loss) to Adjusted EBITDA included on slide 16. Key Metrics Definitions “Systemwide Restaurant Sales” is presented as informational data in order to understand the aggregation of, franchised stores sales, ghost kitchen and corporate-owned stores sales performance. Systemwide restaurant sales growth refers to the percentage change in sales at all franchise restaurants, ghost kitchens and corporate-owned restaurants in one period from the same period in the prior year. Systemwide restaurant same store sales growth refers to the percentage change in sales at all franchise restaurants, ghost kitchens, and corporate-owned restaurants once the restaurant has been in operation after 14 months. See definition below for same store sales. “Corporate-Owned Restaurant Sales” represent the sales generated by corporate-owned restaurants. Corporate-owned restaurant sales growth refers to the percentage change is sales at all corporate-owned restaurants in one period from the same period in the prior year. Corporate-owned restaurant same stores sales growth refers to the percentage change in sales at all corporate-owned restaurants once the restaurant has been in operation after 14 months. These measures highlight the performance of existing corporate restaurants. “Same Store Sales” is used to evaluate the performance of our store base, which excludes the impact of new stores and closed stores, in both periods under comparison. We include a restaurant in the calculation of same store sales once it has been in operation after 14 months. A restaurant which is temporarily closed (including as a result of the Covid-19 pandemic), is included in the same store sales computation. A restaurant which is closed permanently, such as upon termination of the lease, or other permanent closure, is immediately removed from the same store sales computation. Employee complimentary meals are excluded from the computation. Our calculation of same store sales may not be comparable to others in the industry. “Digital Channel Systemwide Sales” is used to measure performance of our digital platform and partnerships with third party delivery partners. We believe our digital platform capabilities are a vital element to continuing to serve our customers and will continue to be a differentiator for BurgerFi as compared to some of our competitors. Digital channel systemwide sales refer to sales generated through the use of digital platforms across all our franchise and corporate-owned restaurants. Digital channel sales growth refers to the percentage change in sales through our digital platforms in one period from the same period in the prior year for all franchise and corporate-owned restaurants. Digital channel orders and digital channel orders as a percentage of systemwide sales are indicative of the number of orders placed through our digital platforms and the percentage of those digital orders when compared to total number of orders at all our franchise and corporate restaurants. “Adjusted EBITDA,” a non-GAAP measure, is defined as net income attributable to common shareholders and controlling interests before interest, income taxes, depreciation and amortization, merger and acquisition related costs, preopening costs, share-based compensation expense, gains and losses on change in value of warrant liabilities, and certain legal matters. 15 15

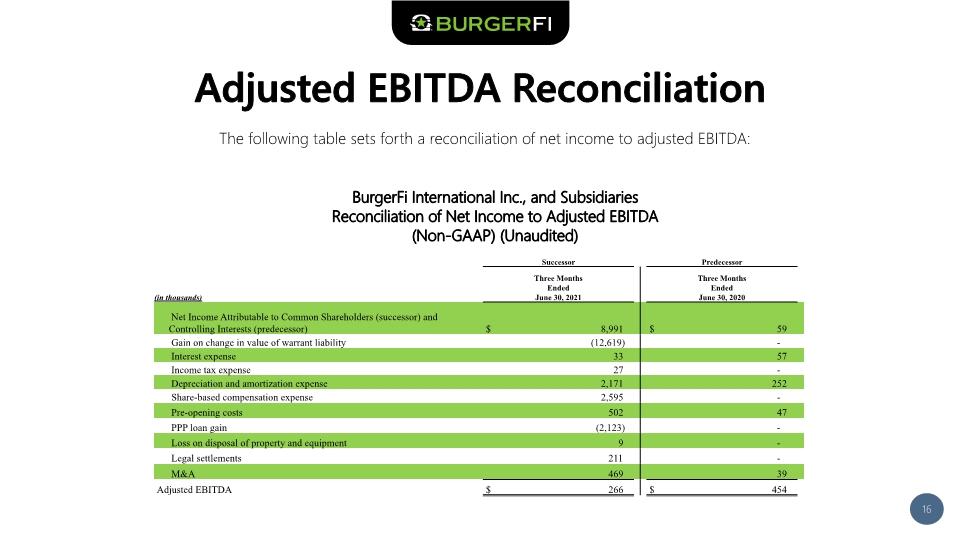

Adjusted EBITDA Reconciliation 16 The following table sets forth a reconciliation of net income to adjusted EBITDA: BurgerFi International Inc., and Subsidiaries Reconciliation of Net Income to Adjusted EBITDA (Non-GAAP) (Unaudited) 16

Contact Us Investor Relations Contact Lynne Collier 646-430-2216 IR-BFI@icrinc.com

Thank you!