Anthony’s Coal Fired Pizza & Wings Acquisition 1 Exhibit 99.2

FORWARD-LOOKING STATEMENTS This Presentation may contain "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995, including statements relating to the Company's acquisition of Anthony's Coal Fired Pizza & Wings and expectations regarding performance and structure following the transaction and continuation of existing lender financing following the transaction. Forward-looking statements generally can be identified by words such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "predicts," "projects," "will be," "will continue," "will likely result," and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our Annual Report on Form 10-K for the year ended December 31, 2020 and those discussed in other documents we file with the Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to BurgerFi or persons acting on BurgerFi’s behalf are expressly qualified in their entirety by the cautionary statements included in this presentation. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. 2

Transaction Summary On October 11, 2021, BurgerFi announced it has entered into a definitive agreement to acquire Anthony’s Coal Fired Pizza & Wings (“Anthony’s”) from L Catterton Total purchase price of $161.3 million, comprised of $33.6 million in common stock, $53.0 million of junior non-convertible preferred equity and the assumption of existing debt of an estimated $74.7 million in net debt, all subject to closing adjustments Existing lender financing has been committed to continue post closing which will include two term loans and a line of credit totaling $71.1M L Catterton will be one of the company’s largest shareholders Andrew Taub (Managing Partner at L Catterton) will join BurgerFi’s board Transaction is expected to close in the fourth quarter of 2021 3

Anthony’s Coal Fired Pizza & Wings Overview Founded in 2002 and headquartered in Fort Lauderdale, FL, Anthony’s is a leading operator of casual dining pizza restaurants Currently operates 61 company-owned restaurants in FL (28), PA (12), NY (5), NJ (8), DE (2), MA (4), RI (1), and MD (1) Stores are predominantly located in suburban strip centers and average 3,200 square feet in size Concept is centered around a 900-degree coal fired oven, and its streamlined menu offers “well-done” pizza, coal fired chicken wings, homemade meatballs, and a variety of handcrafted sandwiches and salads Anthony’s provides a differentiated offering among its casual dining peers driven by its coal fired oven, which enables the use of fresh, high-quality ingredients and supports quicker ticket times Concept is at the intersection of multiple dining trends: small box, fast casual, authenticity, and premium menu offerings Menu consists of ~25 items; simplicity allows for easier execution and growth vs. comparable concepts Wine, craft beer and cocktail selection provides strong alcohol mix (15.9% pre-COVID) 4

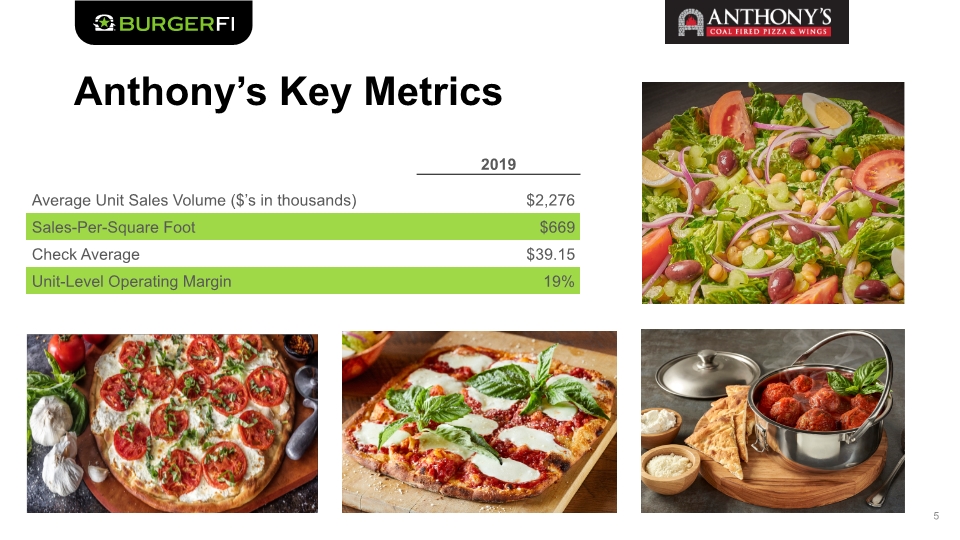

Anthony’s Key Metrics 5

New Growth Opportunities The company has developed a smaller footprint, fast-casual concept (~1,700 square feet) offering further expansion of the brand in existing and new markets, which could provide more attractive investment returns on unit economics. Launched in November 2020, The Roasted Wing is a virtual concept that features Anthony’s signature coal fired chicken wings, as well as garlic knots, offered across all restaurants. Anthony’s is known for their chicken wings, which are marinated overnight with garlic and fresh herbs before being roasted in its 900-degree coal fired oven. 6

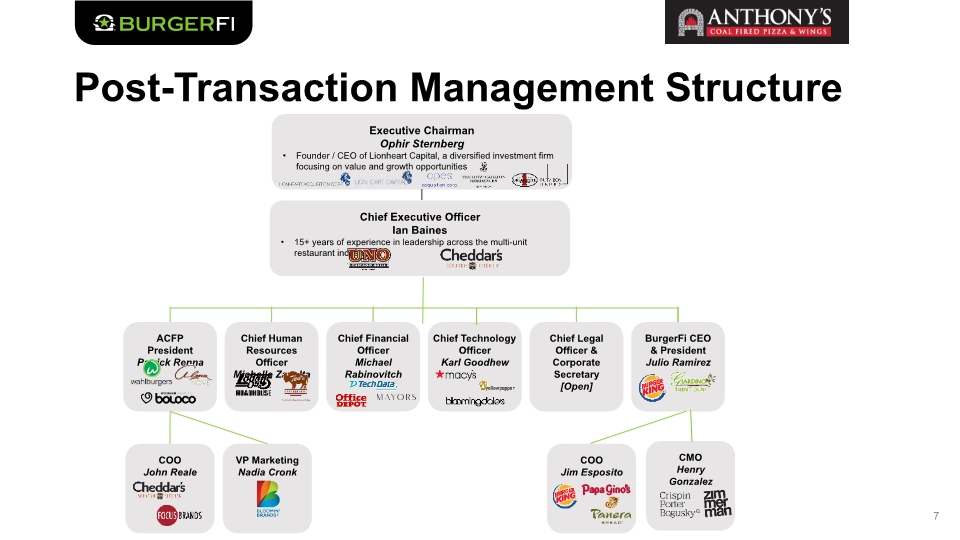

Post-Transaction Management Structure 7 Executive Chairman Ophir Sternberg Founder / CEO of Lionheart Capital, a diversified investment firm focusing on value and growth opportunities Chief Executive Officer Ian Baines 15+ years of experience in leadership across the multi-unit restaurant industry CMO Henry Gonzalez COO Jim Esposito ACFP President Patrick Renna Chief Human Resources Officer Michelle Zavolta Chief Financial Officer Michael Rabinovitch Chief Technology Officer Karl Goodhew BurgerFi CEO & President Julio Ramirez Chief Legal Officer & Corporate Secretary [Open] VP Marketing Nadia Cronk COO John Reale 7

BurgerFi’s Investment Thesis The acquisition is expected to be accretive to EPS to common shareholders and EBITDA in 2022 The combined entity offers a unique opportunity to enhance scale, grow combined EBITDA and produce cash flow to fund future growth Pre-Covid, Anthony’s demonstrated top-tier unit economics with AUV’s of approximately $2.3M, sales-per-square foot of ~$700, and a restaurant-level margin of 19% In addition to growth from Anthony’s core restaurants, additional growth opportunities through a smaller concept footprint and a new virtual brand – The Roasted Wing – provides opportunity for additional growth and revenue streams 8